The second quarter heat began with the President in the Rose Garden on April 2nd holding a huge cardboard poster outlining an absurd set of tariffs, designed, apparently, to upend global trade. Equity and bond markets melted down. The backpedaling at the White House began almost immediately, with extensions, talks, threats, trade meetings, half-deals, more threats, and more extensions…but no real trade deals. It’s not clear what the President wants, but the markets will not tolerate a nonsensical, ham-handed reordering of global trade. He can run roughshod over any and all political opposition, but he can’t bully the markets. With that realization, the market recovery in the second quarter was the fastest on record: just 89 days from the bottom to get back to the old highs. Think about it this way: the markets will likely have the final say on trade, and in a capitalist economy that collective wisdom is reassuring.

Of course, there are always other factors at play. There is a scattering of tariffs in place, including a 10% baseline tariff on most imports, but there’s been little in the way of disruption or extra inflation showing up in the economic numbers. So far, so good. And the President’s big, beautiful bill passed, extending the tax cuts and adding a handful of new ones. (More debt? No. Not really. Well, only a few trillion.) Most significant, however, earnings in the second quarter were fine, with the all-important tech results and especially AI spending remaining strong. The S&P 500 rose nearly 11% in the second quarter with the average large cap stock up over 5% and small caps adding 8.5%. Tech led, with the S&P 500 tech sector up 23%, followed by communications and industrials up 13%. Healthcare and energy struggled, down 7% and 8.5%, respectively. Year-to-date the S&P 500 is up a little over 6% with the average large cap up about 5% and small caps still down 2%. To summarize the first half, I’d say the market narrative hasn’t changed much from the last several years: there was a bit of broadening, but tech and AI still run the show. Consider this: AI titans Nvidia (hardware) and Microsoft (software) are both approaching four trillion in market capitalization, and each is larger than the entire German stock market and combined they are larger than Japan. As they go, so go our equity markets.

Right now, a small cohort of our largest, most profitable companies are funneling hundreds of billions into AI. They are engaged in an all-out arms race. It’s not an exaggeration to say that the sums involved and the pace of investment are unprecedented. I’m uneasy with the idea that we’re seeing one of the biggest capital spending projects ever undertaken and we can only guess what we’re ultimately buying. But let’s not get bogged down in existential questions; we’ll try and stick to the facts. So how is AI doing?

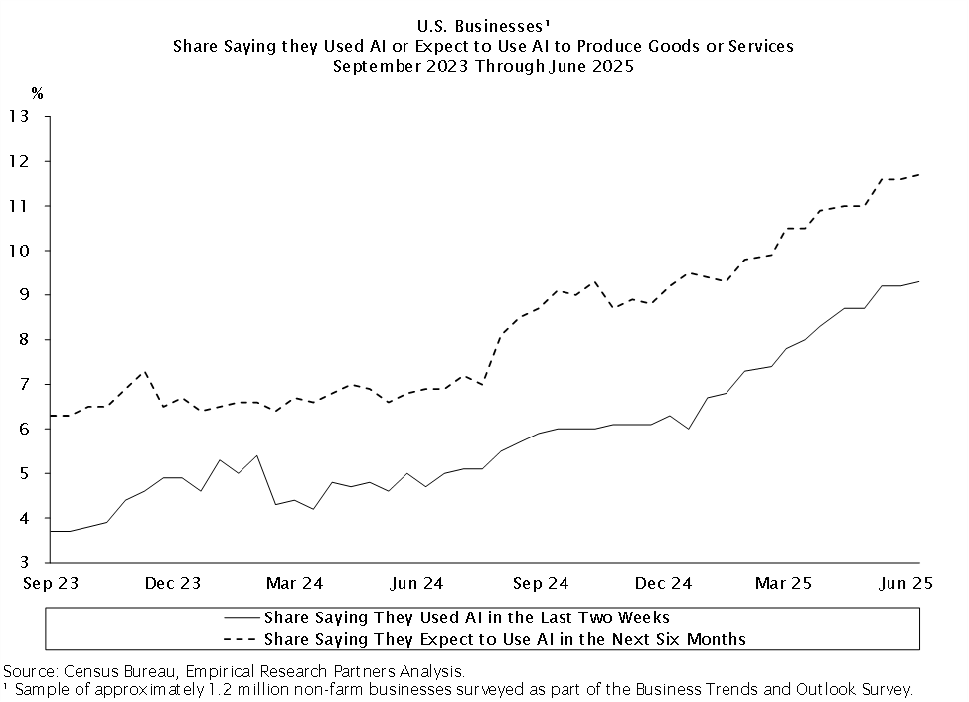

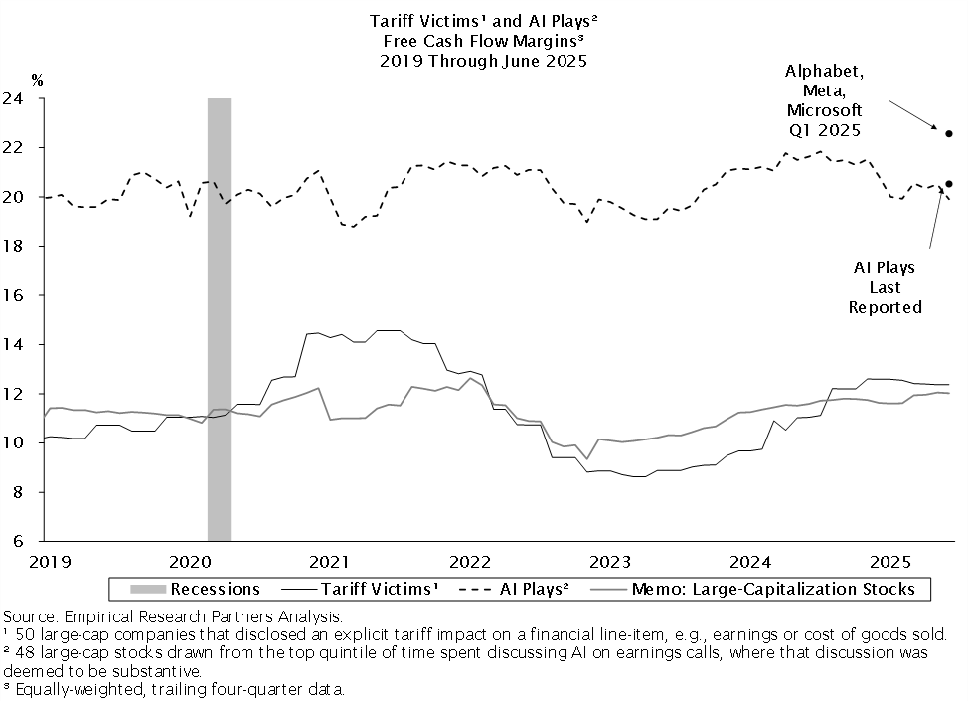

The above graph is a bi-weekly survey of AI adoption showing solid progress. Tracking large language model (LLM) queries, we find workers in software and media and entertainment leading the uptake with retail and transports lagging. This makes sense; AI is already pretty good at coding and generating media, less good at folding shirts. Naturally, the further removed from knowledge work, the lower the adoption rate. Other surveys point to greater adoption at larger firms, higher margin industries and those with educated workforces. No surprises here either. PC adoption followed similar patterns. It seems reasonable to conclude that AI adoption will continue as use cases proliferate; the models are only getting more capable. And while I’m concerned about where AI might take us (my job, for example), the companies funding this investment have the free cash flow to comfortably continue funding this build-out. They are exceptionally profitable on an absolute and relative basis. See the graph below.

As for the market over the next few quarters, I guess flattish. There’s no obvious reason for a crack-up in tech leadership, and it’s already loved and ubiquitous in portfolios. Who’s not on board? Who’s left to buy? As for the rest of the market, it must deal with a sluggish economy, some trade uncertainty and generally full valuations. What surprise is coming for earnings? I’m at a loss. The Fed will probably be cutting rates before the end of the year, but that is long anticipated. We’ve had a great run; a consolidation phase makes sense. Enjoy the rest of this summer, hopefully less hot.

Richard H. Skeppstrom II

Chief Equity Strategist

Richard H. Skeppstrom II serves Brockenbrough as Managing Director and Chief Equity Strategist. He manages two of our investment products and writes most of our investment commentary. Richard joined the firm in 2016 and has 30 years of experience in the investment management industry.

The opinions expressed are those of Brockenbrough*. The opinions referenced are as of the date of publication and are subject to change due to changes in the market of economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed. Brockenbrough is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Brockenbrough investment advisory services can be found in its Form ADV Part 2, which is available upon request.

*Lowe, Brockenbrough & Co. dba Brockenbrough

It Starts Here

Let’s get to know each other.

Existing Clients

Already part of the family?

2nd Quarter 2025 Commentary