Stocks continued to run in the first quarter, with the S&P 500 tacking on another 10.6%, and effortlessly making a series of new all-time highs. I, for one, thought it might take some time before the S&P 500 decisively broke above the high it first made at the end of 2021 and managed to claw back to at the end of last year. Those two years were no easy climb - not Himalayan, but certainly rocky and occasionally unnerving. Of course, we’ll have to come up with a good story to explain why the market so easily punched through, and we will, but first a few more numbers. Mega cap tech continued to blaze the trail, with the Magnificent 7 up 17%. But that wasn’t the whole story, as the return distribution was broader-based and healthier than last year, with the average S&P 500 stock up nearly 8%. Sector returns skewed to the economically sensitive - leading the way were the energy, communications and finance sectors, with returns of 13.5%, 12.7% and 12.4%, respectively. Utilities (+4.5%) and staples (+6.8%) - the safety trade - brought up the rear. Small caps rose 5%, not a bad showing, but still unloved as an asset class, mainly because they are more sensitive to this higher interest rate environment and aren’t nearly as financially robust as their large cap counterparts. Finally, to fixed income. After a couple of years of whipping financial markets around, bonds finally displayed their less frenetic nature. The Bloomberg U.S. Aggregate Bond Index fell roughly 1%, as yields on the 10-Year U.S. Treasury bond ticked up from 3.9% to 4.2%.

So, what do I believe is going on? Markets have concluded that the Fed’s interest rate hiking cycle will not end in recession; rather, we are in the middle of an extended business cycle with the wildcard of Artificial Intelligence (AI) juicing the return. It’s not an illogical conclusion given the evidence. By most measures the economy remains healthy, and inflation has come down significantly. And while it’s not yet at the Fed’s 2% target, it’s getting close and likely to get there. Fourth quarter S&P 500 earnings were up 10%, with most companies enjoying margin expansion. All of this suggests that expectations for 8.5% earnings growth for the S&P500 this year are not only achievable, but they are also beatable. Stock valuations are full but not alarming. What’s not to like? As to why the markets chose the first quarter to stop obsessing about when the Fed might start cutting rates, I will revert to my stock answer. Why do all the starlings go this way, then that?

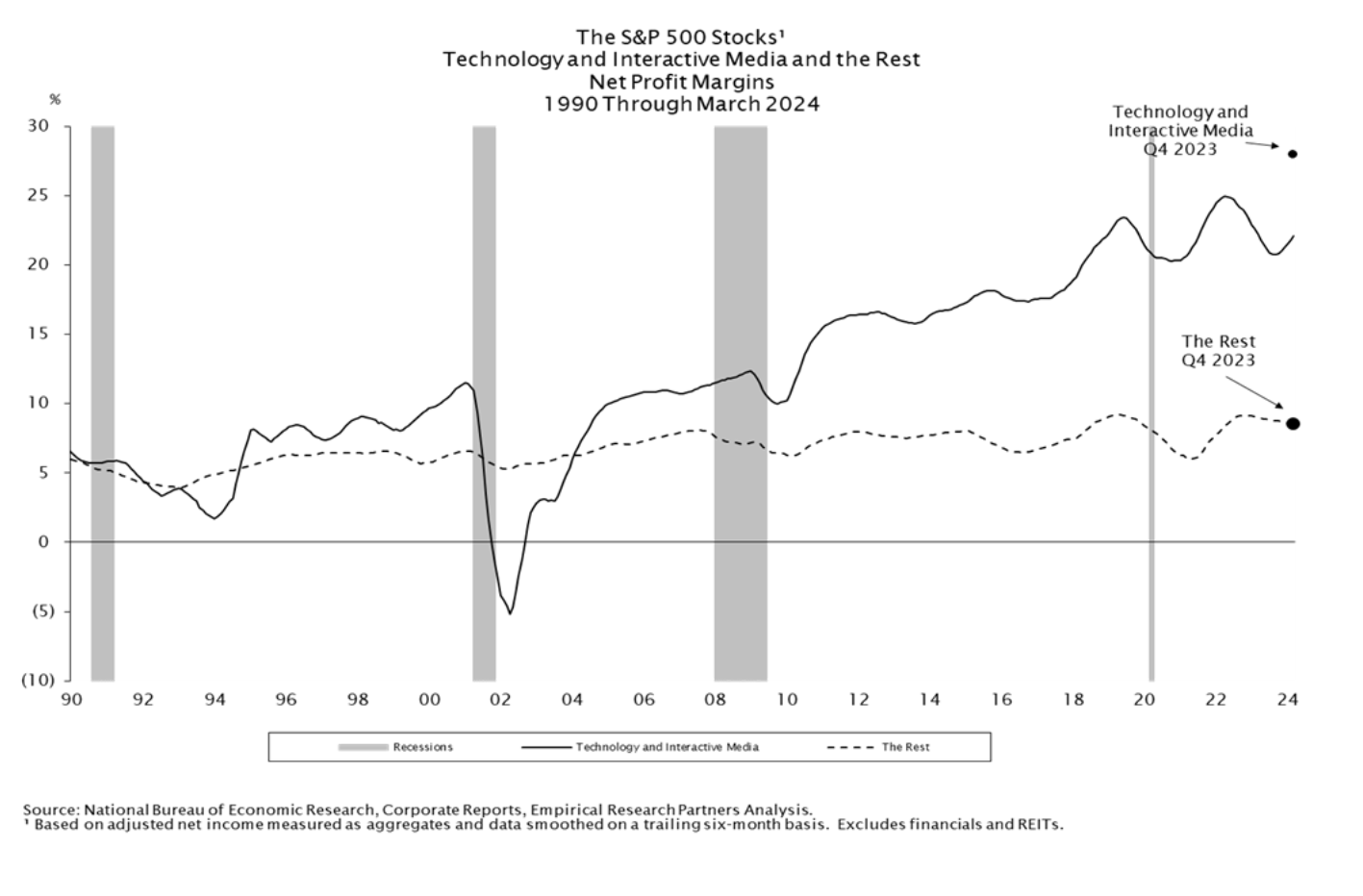

When there isn’t something really attention grabbing or fun to write about, I’m often forced back into a traditional ‘strategist’s’ voice. This can require a chart or two, but for this, mercifully, one will do.

The above chart shows the S&P 500’s net profit margin broken out basically between tech and everything else over the last 30+ years. This is the internet, wireless, smartphones, social media, the cloud, green energy, electric vehicles, AI, and all the connective hardware, software and semiconductor advances in between. Many of these companies are remarkably profitable with huge global market share - borderline monopolies really. This transformation of our human experience also thoroughly upended the composition of the U.S. stock market, a market that was once dominated by slower growing, less profitable cyclical companies like Exxon and GE. The S&P500 is more profitable, generates more cash flow, is less cyclical and grows faster than it otherwise would have because of tech’s growing influence. The exceptional health of these businesses is also the principal reason, in my opinion, that the market ignores hell’s own laundry list of problems we face. And I believe it’s reasonable to conclude that technological advances will eventually address some of them.

This was a fairly sunny review. The news has been good. We obviously face some difficult challenges, and at some point this letter will be knee deep in it, but for now let’s enjoy the renewal of spring and the good fortune we have.

Richard H. Skeppstrom II

Chief Equity Strategist

Richard H. Skeppstrom II serves Brockenbrough as Managing Director and Chief Equity Strategist. He manages two of our investment products and writes most of our investment commentary. Richard joined the firm in 2016 and has 30 years of experience in the investment management industry.

The opinions expressed are those of Brockenbrough*. The opinions referenced are as of the date of publication and are subject to change due to changes in the market of economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed. Brockenbrough is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Brockenbrough investment advisory services can be found in its Form ADV Part 2, which is available upon request.

*Lowe, Brockenbrough & Co. dba Brockenbrough

It Starts Here

Let’s get to know each other.

Existing Clients

Already part of the family?

1st Quarter 2024 Commentary