Summer ends…again. Always too short; difficult to let go. Football and cool mornings are welcome, but there’s a heaviness to it. It’s cliché, but winter is coming--commutes in the cold and dark, and a reckoning with the year’s end, and what could have been. But it was a good summer…aren’t they all, mostly. It began with the markets just touching into bear market territory as extreme hand-wringing about a possible recession gave way to somewhat more encouraging data, both on the economy and corporate earnings. Stocks rallied hard through the middle of August as the warm weather, long weekends, and, most obviously, lower gas prices had markets hoping (yes, markets can hope) core inflation might be ebbing. Unfortunately, not yet. The late August inflation readings crushed hope, and left little doubt that the Fed had more to do. Still, equity markets ended the summer a tad above where they began. As we said, it’s not easy to ruin summer.

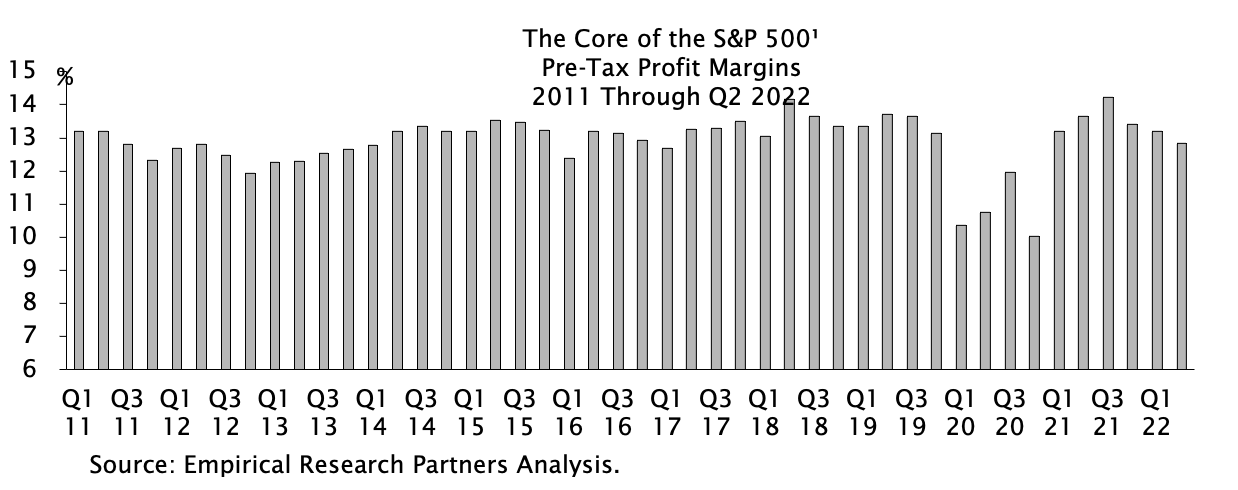

As referenced above, corporate profits have mostly held up. Stocks have traditionally been considered inflation pass-throughs and that looks reaffirmed. The chart below shows the last ten years of the core of the S&P500’s pre-tax profit margins. They’ve declined a little but are still in the range of the last ten years. This is the critical factor in the resiliency of the markets in the face of an abundance of bad news. Profitability has not only held up but remains robust, and it’s worth noting why. Our markets are no longer headlined by plodding, deeply cyclical businesses. In fact, just the opposite. A sort of cream of global franchises has risen to the top of our large cap universe. Monopolies might be an overstatement, but it’s close. And they’ve had decades to fine tune not only their markets but also their costs and internal controls. They are formidable. That’s not to say a recession wouldn’t dent their earnings; it would, but to what degree is an open question. As for the more pedestrian areas of the market, an average recession will produce a significant decline in earnings.

The Good, The Not So Bad, The Ugly, and the Delicious