Last year we ended our 2020 summary thusly: “… the economy and, therefore, earnings aren’t in danger of rolling over ... we’ll be ok.”

We based that prediction upon the strength of the economy, fiscal and monetary engagement, and the promise of vaccines. And even while shouldering the slow torture of new variants, we mostly got back to something more normal. But we never imagined a 2021 S&P 500 up nearly 29%, 11% alone in the fourth quarter. Large cap growth and value did nearly equally well. Technology, up 35% on the year, was handily bested by Energy, up a whopping 53%. Recall in 2020 oil somehow briefly traded at a negative price, and investors puked out their energy holdings. Whipsawing is still alive and well. 2021 was also good for small caps, but not great, with the Russell 2000 up 15% for the year. Speculation cooled in small cap growth, up only 3%, but small cap value ripped, up more than 28%, thanks to big weights in energy and finance. Bond returns were slightly negative, but with yields so low, not an unexpected result.

It was a hell of a year, all the way around. And we’d be left scratching our heads at the superlative equity run except for one fact: earnings were just that strong. Coming into 2021, analyst consensus expectations for S&P 500 earnings were to approximate pre-pandemic 2019 earnings of $170/share. They’ll come in somewhere north of $210/share, more than 20% above expectations. Exceptionally strong demand coupled with lean cost structures explains much of the story, nowhere better exemplified than the ultra-mega-cap leadership of FAANG and friends. It’s a happy, if highly unusual, circumstance to have the largest businesses ever created also be some of the most profitable and fastest growing.

But it didn’t all make sense. While some of the speculative juice ran out of small caps and the Covid-19 lucky, there are still noteworthy pockets, at least to our eyes. Sometime during 2021 we started hearing the term Diamond Hands. It refers to, we believe, retail investors who will under no circumstances sell a treasured asset (meme stocks, theme stocks, crypto, etc.) no matter the absurdity of the investment case. It seems to us that there’s a gamification of investing going on, and it may be coincidence, but you can’t tune into televised sports without being bombarded with ads for new sports betting sites. We’re particularly put off by the ad in which Matt Damon struts down something resembling a hall of fame of mankind’s feats, daring us to invest in crypto, all the while dangling rewards such as discovering the new world or summiting Everest. Yuck. If we had to guess, crypto will become a bigger problem. It’s been described as the perfect speculation. We as a species are wired to fall for a perfect speculation.

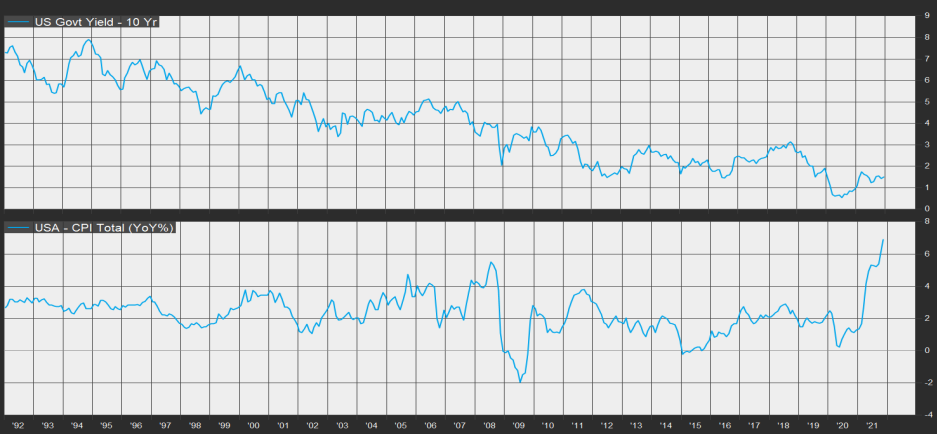

And 2021 served up other oddities. The FACTSET chart above is arguably one of the most astonishing of our career: exploding inflation with interest rates near historic lows. It’s not supposed to look like this. The last time inflation was this high, the 10-year Treasury was yielding 11%. Ongoing mammoth global central bank bond purchases combined with very low to negative bond yields in the developed international markets are undoubtedly pushing/holding domestic yields down. Add in the trillions of fiscal stimulus, and what you have is an injection of liquidity on a scale heretofore unseen, inflating and overrunning a supply-constrained real economy, and leaking, gushing actually, into the financial system. Everything’s being bid up: beef, bourbon, baristas, boats, and, yes, bonds. Ok, we like the b’s, but it doesn’t matter what letter you start on.

If there’s been a policy mistake here, it’s that the pandemic’s damage to the economy wasn’t really like a typical recession where an overheated economy stumbles, squeezing credit, capital spending and employment, and abetting an economy-wide recursive cycle of demand destruction. No. It was more like a tornado blasting down Main Street, demolishing a frightening number of store fronts, but leaving the bulk of the town’s economy untouched. The Fed’s action in March of 2020 (backstopping the entire bond market) absolutely averted a bankruptcy catastrophe, but once the bond market stood back up (amazingly quickly, actually) and the government was able to get assistance to those directly in need (and too many that weren’t), there wasn’t that much demand destruction. But the extraordinary measures (massive bond buying and 0% interest rates) kept coming—the old playbook. Actually, it’s the new playbook invented during the global financial crisis, and then defaulted to for the pandemic. So it’s pretty new as Fed playbooks go, but, to our minds, getting old.

This quarter, fortunately, the Fed finally clued in and stopped talking ‘transient’ inflation, began to taper bond purchases, and brought forward rate hike expectations. But the economy is overstimulated and could strengthen rapidly, as the Omicron wave appears much less deadly and, hopefully, passing quickly. The labor and housing markets will remain tight. (We have supporting charts, but don’t want this thing to get too charty.) This argues for persistently higher inflation, even if supply chain bottlenecks are resolved, as we believe they eventually will be. This is a critical juncture. Powerful forces are realigning as it relates to interest rates. The Fed very well may be behind the curve - Wall Street speak for they may have to raise rates beyond expectations to slow things down. Another fear is a sudden surge in longer rates. We’re concerned; we’ve said for a long while now that bond yields are too low. They should rise some, but this isn’t the 1970s. There’s too much low cost debt in the system for a simple return to previous constructs.

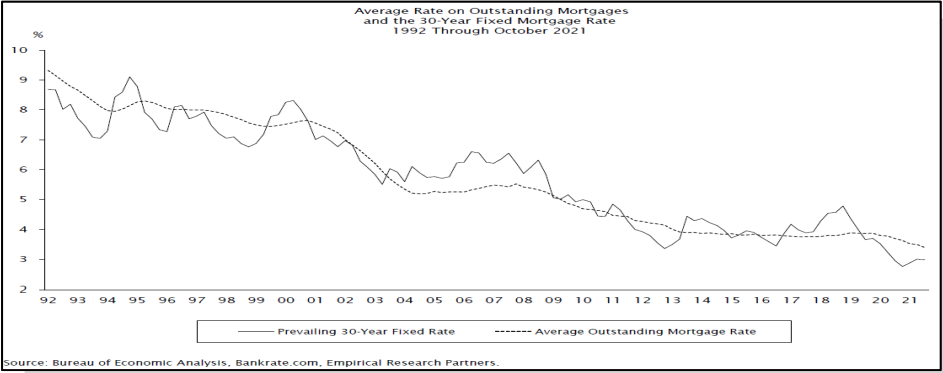

Here we are going to get a little charty one last time. Below is a graph of the average interest rate on existing mortgages plotted against current mortgage rates. When the current mortgage rate rises above the rate on the existing stock of mortgages, the housing market slows because people don’t want to or can’t move into a more expensive mortgage (home), and that’s a big enough brake to slow the whole economy. If longer rates rise too much (more than another 1.25% or so), the housing cycle rolls over, slowing the economy and taking rates, and inflation back down … hopefully. That we’ve financed/refinanced the stock of mortgages at this very low level is a natural governor on rates. The same dynamic applies to everything else financed with very low cost debt, more or less.

And that’s enough on bonds; we’ll end on stocks. Historically speaking, initial Fed rate increases aren’t bad for equities. It typically means the economy has sufficiently recovered from the previous recession, and the Fed is simply normalizing policy. It actually can be quite bullish, an unambiguous signal that the economy and, therefore, earnings will be reliably strong for the foreseeable future. But this time the economy is already unusually strong, and the Fed is still near maximum accommodation, regardless of rhetoric. Normalization now is a recipe for turmoil in some areas, given the carelessness and speculation that’s gone on. As we mentioned earlier in this note, some pandemic high flyers have returned to earth. We bet there’s more pain coming for the speculative trades and traders. Diamond hands? Honestly, one comes to resent new players making up new rules and flouting convention…especially when it works. We really wanted to say something ugly about those unbreakable hands, but let’s just leave it at this: they’ll find it hard to keep a solid grip on investments unsupported by earnings or promises to pay when they are mercilessly revalued.

Turmoil isn’t necessarily all bad if the speculative gets hit and the cheap catches a bid. We’d expect a backdrop of higher nominal economic growth to favor the more economically-sensitive sectors as their earnings are more geared to the economy relative to the growth stocks. They’re also cheaper. The ever discussed growth-to-value stock transition could be in the offing. But there’s a big difference between absurdly priced growth stocks with no earnings and expensive growth stocks with extraordinary earnings and profits. As we’ve written before, there’s a cadre of ultra-mega-cap growth franchises whose margins and cash flows are incomparable. Most have staked out near monopoly positions in critical areas of long term growth and change in our economy. Think: the cloud. We want to own these businesses even if they must underperform periodically, as they surely will, because they will grow out of their problems, and we’re not smart enough to jump in and out. Therefore, as the backdrop warrants, we will continue to have bets in both the growth and value camps.

We know you’re having trouble believing how well equities have done, especially given the struggles and absurdities we’ve faced … and will face. You’re considering ways to hop off the crazy train. We don’t have an easy answer. Stick to your long term plan, but expect lower returns. Our view is that the economy and therefore earnings will be strong again in 2022. Earnings are the bedrock of the investment equation, and in our minds, at least for now, trump the Fed. Why? Because the Fed really doesn’t have much room to maneuver. We expect stock returns to be volatile but positive and better than bonds. But let’s be clear: if quality fixed income is part of your plan, stick with it; it’s there for your protection.

The opinions expressed are those of Brockenbrough*. The opinions referenced are as of the date of publication and are subject to change due to changes in the market of economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed. Brockenbrough is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Brockenbrough investment advisory services can be found in its Form ADV Part 2, which is available upon request.

*Lowe, Brockenbrough & Co. dba Brockenbrough

It Starts Here

Let’s get to know each other.

Existing Clients

Already part of the family?

4th Quarter 2021 Commentary