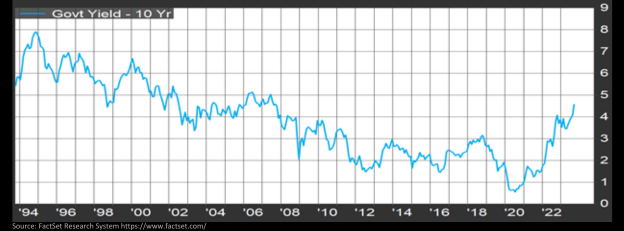

Above is a thirty-year chart of the 10-year US Treasury bond yield. If the chart could go back 40 years, it would look much the same: bond yields relentlessly stair-stepping down as investors gradually accepted that the 1970s inflation was truly dead and global growth was slowing. We can’t know where rates might have gone in the absence of the Great Recession and the Covid-19 pandemic, but these events unleashed Fed interest rate suppression (zero rates and bond buying) on a scale theretofore unheard of, concluding in yields crashing to historic lows as lockdowns began. We all know what happened next. Cruelly, ironically even, inflation surged as the economic reopening, over-lubricated with extreme monetary and fiscal stimulus, ran headlong into supply chain chaos and labor shortages. The Fed eventually reversed course, but the damage was done. It's stunning, really--decades of declining yields culminating in a historic collapse, only to be violently reversed. The benign narrative of permanently lower rates has been overthrown.

Helpfully, inflation has come down, but getting from 3% to the stated Fed goal of 2% will be more difficult. Interest rate policy normally works through the labor and housing channels; unfortunately, we have structural shortages of both, making rate increases less potent. Higher rates for longer are now the consensus view.

But before we get any further into the weeds, we’ll recap the highlights from the third quarter. In short, almost everything except short-term bonds struggled, as is often the case when rates are rising. The Bloomberg U.S. Aggregate bond index lost 3% in the quarter. The S&P 500 index also lost 3%, with small caps down 5%. Even the Magnificent Seven retreated 1%, but they’re still up 84% for the year, contributing most of the S&P 500’s 13% year-to-date gain. Utilities fared the worst (they compete with bond yields), down 9%, while the energy sector shined, gaining 12% on surging oil prices. OPEC has been cutting global supply. Let’s hope the horror inflicted upon Israel doesn’t morph into a regional war, but the barbarity of the attacks will bring a devastating and sustained reprisal. Even striking Iran, Hamas’ state sponsor, is probably on the table. $150 oil would likely be too much for a world economy already dealing with a rate shock.

Interest rates stayed in the 2% to 3% range for almost a decade before collapsing in 2020. That’s a long run, certainly more than long enough to feel normal. But it wasn’t normal. The Fed was suppressing yields. Said another way, they were keeping the cost of debt artificially low, and the U.S. and global economy became acclimated (hopefully not addicted) to the cheap money. We are finally on the other side of that regime, at least until the next calamity. Interest rates will almost certainly find a higher range, and we believe we’re close. Not a lot higher or something else important breaks. And not a lot lower given the trillions in forever-deficits that must now compete for the world’s savings. So, our best guess is the 10- year yield settles in somewhere between 4% and 5%, about where it was before the Great Recession and the Fed began its rate suppression experiments. That may not sound scientific, and that’s because it isn’t.

Stocks have two more hurdles to vault before we can rest easy. First, markets will have to see convincing evidence that the Fed’s rate actions are finally slowing the economy and that probably means labor market weakness. And second, they can’t have gone too far and tipped us into recession. We should have an answer in the next few quarters. Stay tuned.

Richard H. Skeppstrom II

Chief Equity Strategist

The opinions expressed are those of Brockenbrough*. The opinions referenced are as of the date of publication and are subject to change due to changes in the market of economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed. Brockenbrough is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Brockenbrough investment advisory services can be found in its Form ADV Part 2, which is available upon request.

*Lowe, Brockenbrough & Co. dba Brockenbrough

It Starts Here

Let’s get to know each other.

Existing Clients

Already part of the family?

3rd Quarter 2023 Commentary